A new identity for start up company Luxe Investments

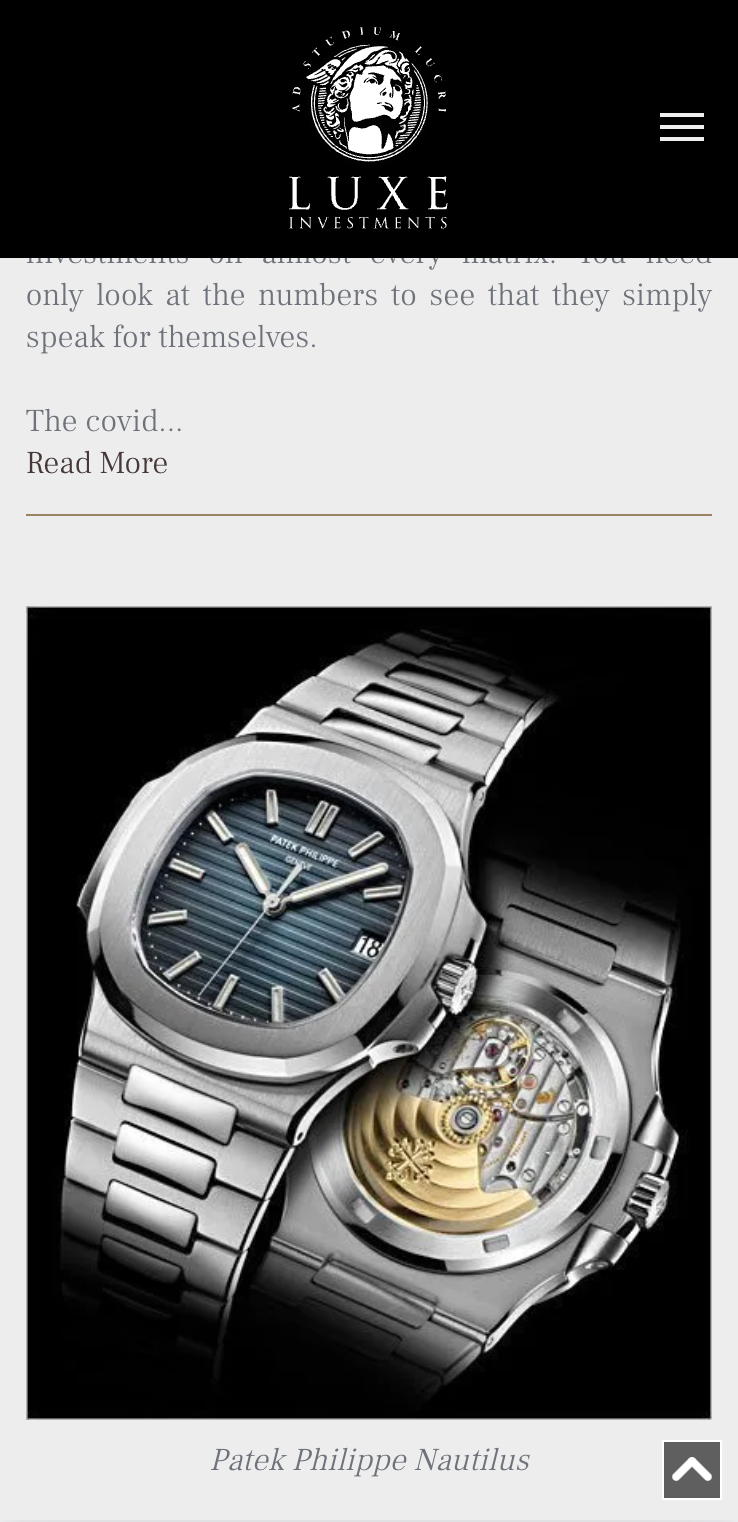

The covid pandemic has served as a catalyst to allow the luxury goods market to flourish. Such investables have become more accessible and liquid than ever, with demand from all four corners of the globe. Fuelled by a younger generation of investors, who are shunning traditional investments – like equities, bonds and commodities, which are perceived as boring – luxury assets can be bought, enjoyed, shown off and then disposed for a potentially generous profit.

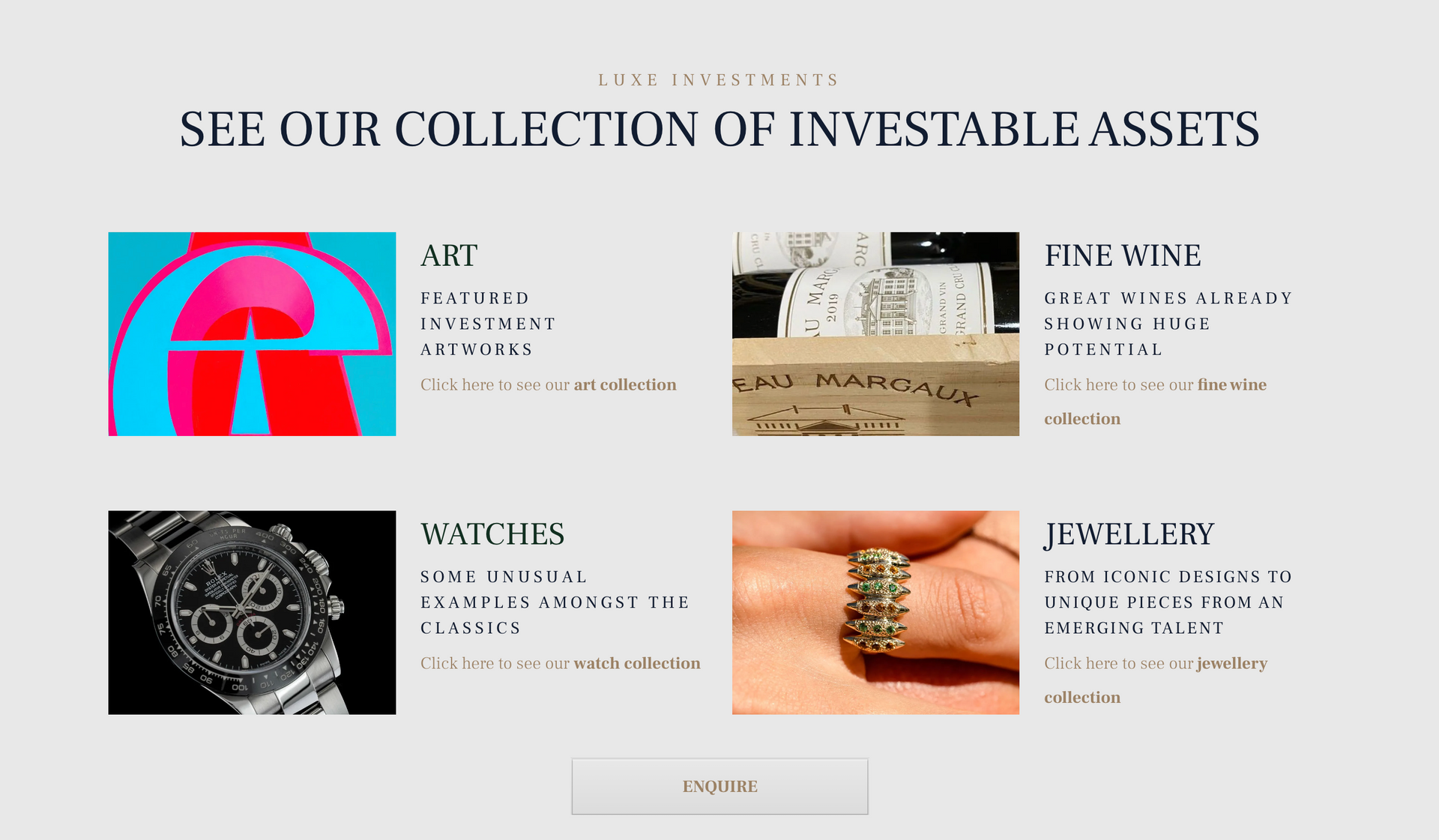

At Luxe Investments we only showcase artifacts that we would own ourselves as part of a broader collection and diversified investment portfolio. They are carefully researched and selected for their interest, beauty, rarity, value and, importantly, their medium to long term investment potential.

BRAND IDENTITY / WEBSITE /

OUR STORY.

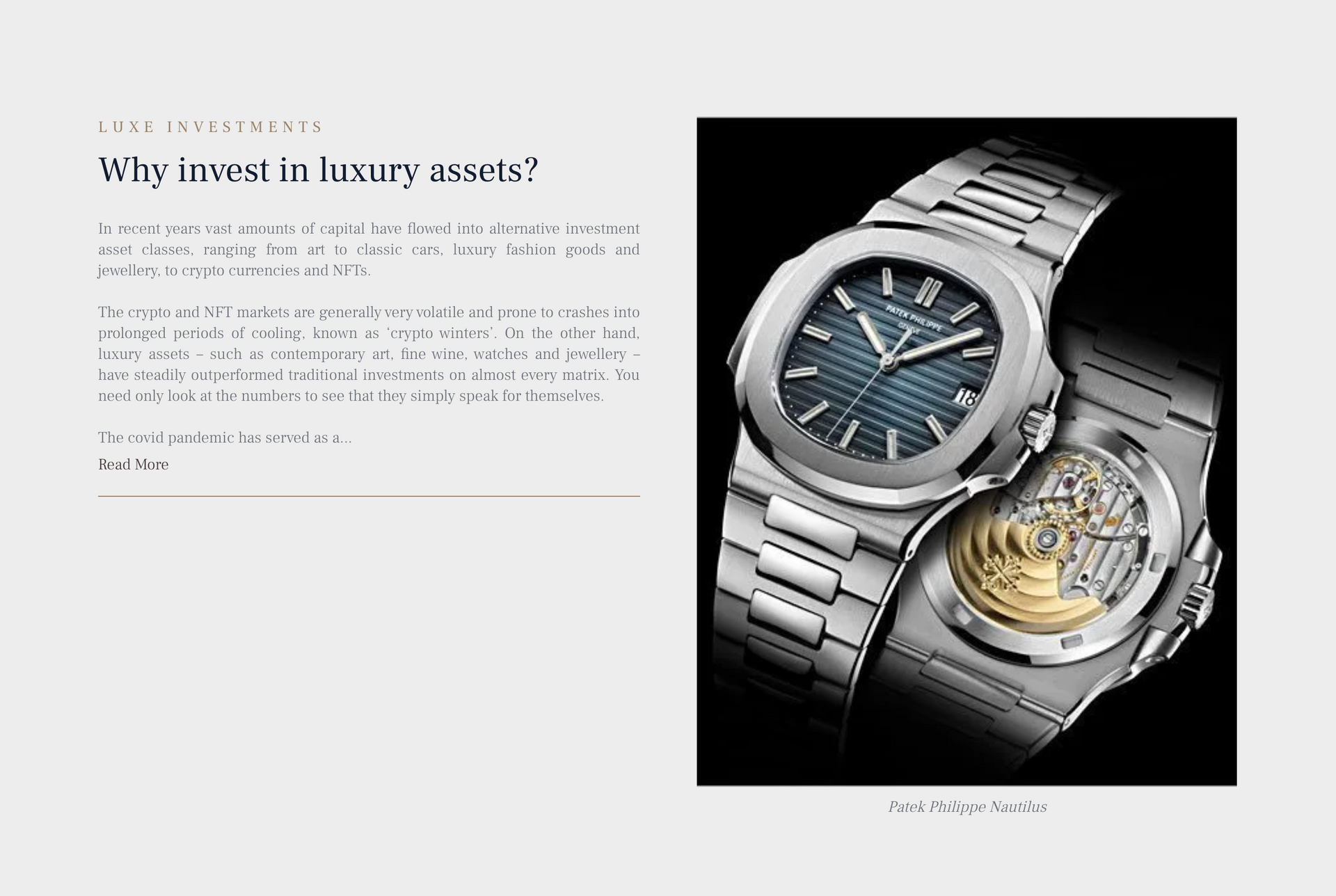

Fuelled by a younger generation of investors, who are shunning traditional investments – like equities, bonds and commodities, which are perceived as boring – luxury assets can be bought, enjoyed, shown off and then disposed for a potentially generous profit.

At Luxe Investments we only showcase artifacts that we would own ourselves as part of a broader collection and diversified investment portfolio. They are carefully researched and selected for their interest, beauty, rarity, value and, importantly, their medium to long term investment potential.

Luxe Investments the brain child of Marios Poumpouris.

The covid pandemic has served as a catalyst to allow the luxury goods market to flourish.

MARIOS POUMPOURIS | FOUNDER/DIRECTOR

All that glitters is not Gold, or is it?

‘I TREAT CLOTHING OR A PIECE OF JEWELLERY LIKE IT WAS A PIECE OF ART.'

DAPHNE GUINNESS

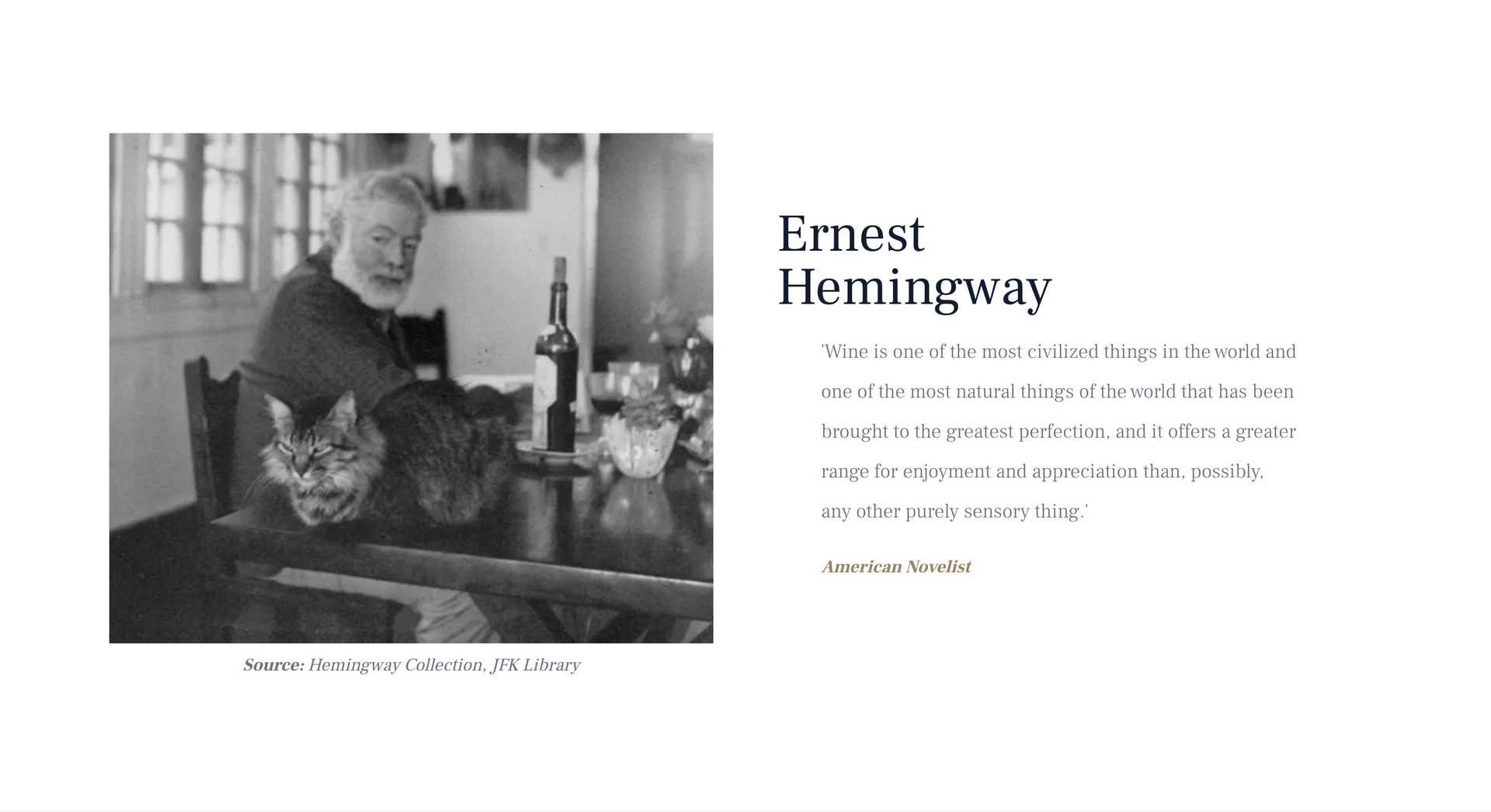

LUXE FINE WINE INVESTMENTS

A TRULY LIQUID ASSET

'A REAL CONNOISSEUR DOES NOT DRINK WINE BUT TASTES OF ITS SECRETS.’

SALVADOR DALI